Displaying VAT on Bookings and Reports

Display VAT on bookings and see the breakdown of your costs excluding VAT, the VAT amount itself and the total including VAT.

By default, every Anytime Booking account will display the total cost before any deductions for taxation.

Disclaimer: Anytime Booking is not an accountancy software and cannot act as an invoicing system. All payment-related emails serve as receipts for payments received against bookings.

Table of contents

1. How to switch on VAT

2. How VAT is displayed on the Booking Summary

3. Reporting - Cashlist and Bookings Report

4. Displaying the VAT in a templated emailed

5. Choosing whether a unit of accommodation is inclusive or exclusive of VAT when placing pricing into your account

How to switch VAT on in your Anytime Booking account

Click on your initials on the top right-hand corner of the Dashboard and navigate to Your Account > Account Settings > Enable VAT. You can place in your VAT percentage.

Caution ⚠️ if you are already actively taking bookings, changing this setting will only affect how bookings are calculated going forward. If you would like all your past bookings recalculated, please contact support.

How this is displayed on the Booking Summary

When you enable this feature, this will only update the admin area view of your bookings. When you open a booking you’ll notice a further breakdown of costs

Tip: If you would like your guests to see the VAT breakdown in the Booking Summary, you will need to contact us to enable this.

Reporting - Cashlist and Bookings Report

When you next view your Cashlist and Bookings report, you’ll notice extra columns for Total (Exc VAT), the VAT itself, and Total (incl VAT). Below are two examples.

Cashlist Report

Bookings Report

Displaying the VAT in a templated emailed

We do have tokens available to add the VAT breakdown to your payment email templates. When you open Tokens, look for Total (NET) and VAT. See below.

Can I choose whether my unit of accommodation is inclusive or exclusive of VAT when placing all my pricing into my account?

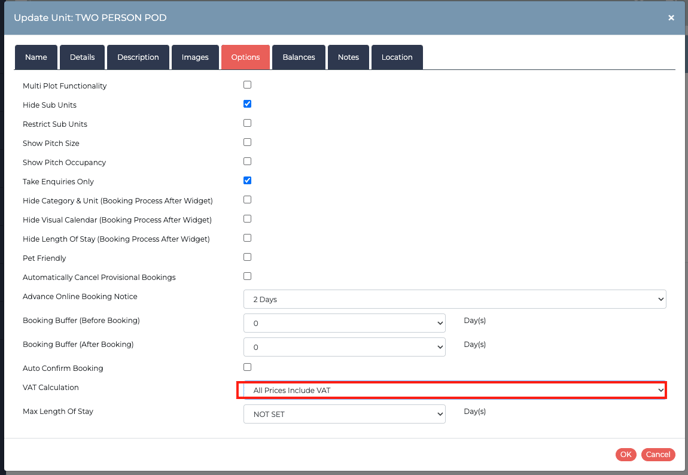

You can switch the units of accommodation to be inclusive of VAT by going to Configuration > Units > Options tab and you’ll see the option 'VAT Calculation' with the dropdown to choose whether to exclude or include VAT.

Caution ⚠️ when you enable VAT on your account ALL units will default to cost inclusive of VAT (at the percentage you stated in Your Account).

A note for customers using Anytime during the COVID-19 years

If you were active with us during the period 1st October 2021 to 1st April 2022, you'll remember there were changes to VAT. The Government increased it from 5% to 12.5% on the 1st October 2021 and then back to 20% on April 1st 2022. It's worth noting that whatever VAT you have stored in your account at the time of booking is the one that is fixed for all payments.

So, if you changed the VAT value in your system on 1st October 2021 to 12.5%, all bookings from that point onwards will display the VAT breakdown at this level. Then if you changed back to 20% from the 1st April 2022, all bookings from that point forwards will be calculating back at the usual rate.

If a booking was made before 1st October 2021 and there is a balance payment yet to be made by the guest, you will need to manually adjust the VAT value in £ after the balance payment was made.

Please check with your bookkeeper or accountant on how you want to record and monitor bookings and their associated payments during this VAT change transition.