Agency Module: Your Owner Reports

This guide will give you all the information you need about your owner reports.

Expenses

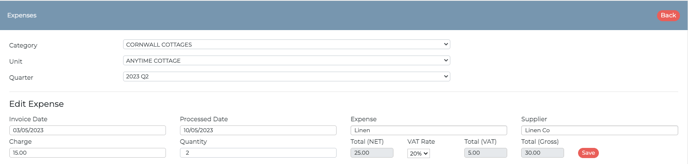

Recording Expenses

If you are looking after a property, you may need to mark expenses against it and deduct these from the owner's booking income earnings. If you do this regularly, you may find the expenses area useful for this.

Go to the left hand menu bar and select Owners > Expenses & Credits > Expenses.

When generating an expense, you can assign the date you were invoiced, the date you are processing it, the name of the expense itself as a free text field (e.g. cutting the grass) and the supplier. The supplier field will automatically look for any supplier already set up within your User Settings. Then add your charge, quantity and VAT, and the total will be worked out for you.

Tip: when recording an expense inclusive of the VAT, the VAT breakdown will appear after you have selected your percentage.

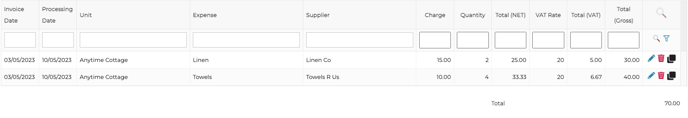

Once you have clicked 'Save', it will be viewable below for your reference. You'll also see the options to amend, copy, or delete the expense on the right hand side.

Expenses will be deducted from the owner statement and commission & VAT report.

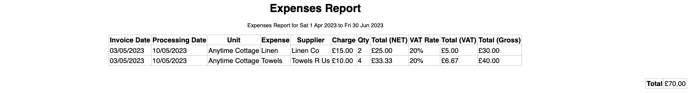

Below is a sample of how the expenses report will display:

Credits

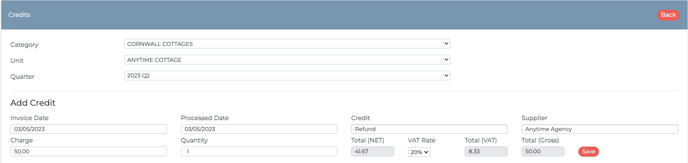

Recording a credit

The process of recording a credit for owner report purposes works in the same way as the expenses.

Add in the date, process date, expense and supplier (e.g your company), along with the charge and quantity. You can also calculate the VAT on the credit too.

The details of the credit will show below for reference. Again, you can amend, copy or delete the credit using the column on the right hand side.

Credits will display as an increase in costings back to the owner on the owner statement.

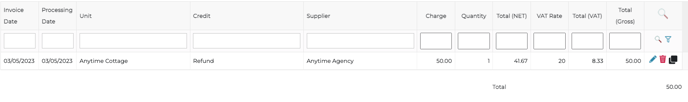

Below is a sample of how the credits report will display:

Please note: if you are refunding a guest, it's important to add the refund onto the credits section under 'Owners' to ensure the monies payable are accurate.

Commission and VAT Report

The Commission & VAT Report is a way of tracking the total income of your bookings on each property on your account. This is broken into three columns for you to see clearly: the commission charged (Net); The VAT element of your commission( VAT); the commission including the VAT (Gross). You can also see the total cost of the expenses recorded and what you would have paid the owner.

Owner Summary/Owner Statement

The owner summary/statement allows you to generate a report based on the property owner and all their assigned properties, or by the property itself. If you leave either the owner or unit fields blank, it will generate a report for everything.

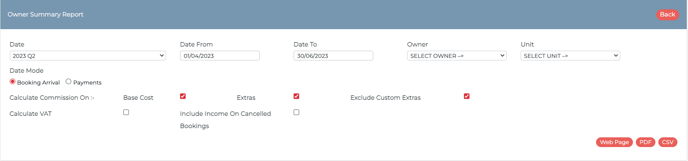

When generating the report you have the option to show different fields.

By default the commission will be calculated on the booking arrival date, base cost and extras (if not excluded from the summary), and exclude custom extras. You can untick any fields that are not applicable to your report or change the report to look at payment dates.

You can also calculate VAT on the report (which breaks down the total (net), total (VAT) and total (gross).

Lastly, you can decide if you wish to include income on your cancelled bookings.

When generating the report you have the option to export to a webpage for your own viewing, PDF (so you can upload to the Documents area for your owner to view) or a CSV file should you wish to amend the data.

Before generating the report for the first time we suggest heading to Report Configuration. Here you can add your logo, address details and more which will appear at the top of the report.

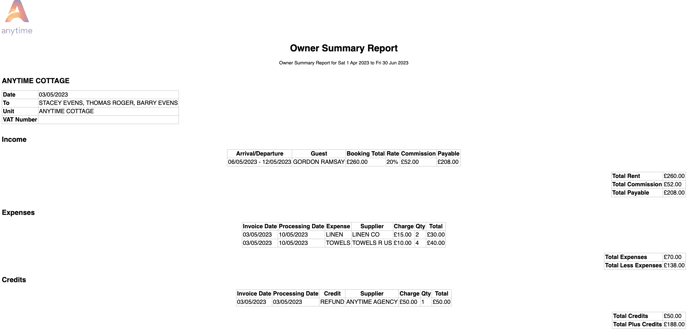

Once the report is generated you will see the bookings with commission, expenses, and the credits with a total income at the end of the page.

Unit Money Holding Report

This is a simple report that allows you to quickly view the monies received, or waiting to collect during a quarter or date range. To get the full financial details, generate a Bookings Report.